what is liquidity in a life insurance policy

What does liquidity refer to in a life insurance policy. So if something happens and you need money quickly you can get it from your life insurance policy.

Life Insurance Liquidity Achieve Financial Goals Paradigm Life

What does liquidity mean in a life insurance policy.

. A highly liquid asset is one that can be turned into cash. Some life insurance policies offer cash values that can be borrowed at any time and used for immediate needs. What does liquidity refer to in a life insurance policy.

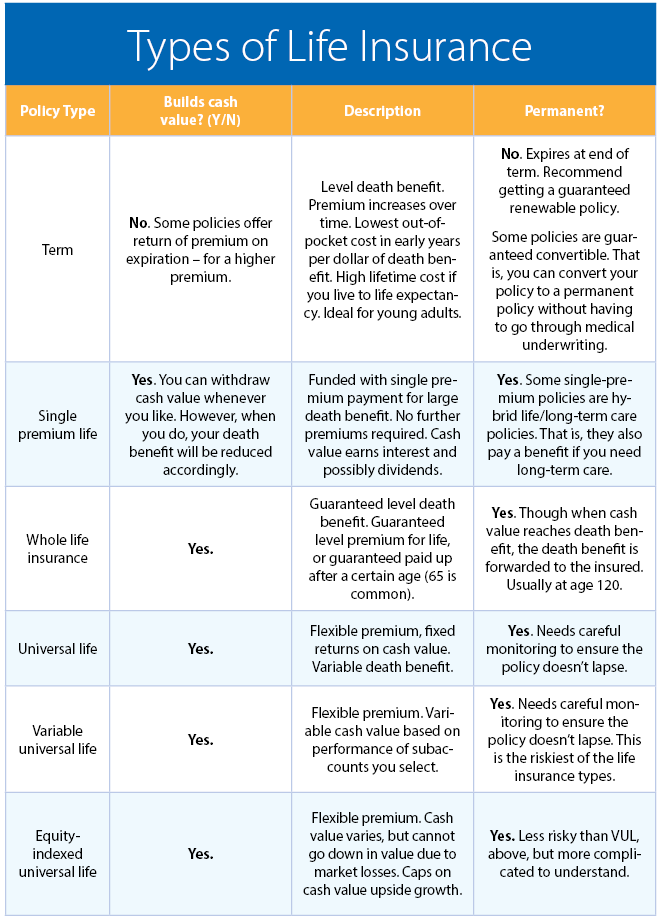

A life insurance policy is an agreement between the insured and the insurance company. The liquidity in a life insurance policy refers to how easy the policy can be exchanged for cash without losing its value. In life insurance liquidity refers to the cash value of permanent life insurance policies including permanent life insurance universal life insurance and variable life.

Liquidity refers to a persons or companys availability of cash. The concept applies mostly to permanent life insurance because it. A life insurance policy aims to provide a death benefit to your beneficiaries.

Bottom Line Up Front. This article looks at liquidity in life insurance policies and how it can benefit policyholders. Benefits of liquidity in a life insurance policy.

In short liquidity refers to the ability of a policyholder to access their benefits promptly. Liquidity in life insurance is the ease with which a. You can achieve that liquidity by borrowing.

Liquidity refers to how effortlessly you can convert an asset into cash. With respect to life insurance liquidity refers to how easily you can access cash from the policy. However permanent life insurance coverage is accompanied by.

What is the meaning of liquidity in insurance. When it comes to life insurance policies liquidity refers to how easily you can get cash from your insurance policy. The notion of liquidity applies to insurance.

Liquidity in life insurance refers to your ability as a policyholder to convert the policy into cash especially in an emergency. In the context of insurance liquidity refers to how easy it is for a policyholder to access cash from their life insurance policy. Therefore your policy must have a cash value.

The insurance company agrees to pay a stated. When it comes to life insurance whole life and. Liquidity refers to how effortlessly you can convert an asset into cash.

What is a life insurance policy. Despite the fact that life insurance plans are designed to offer financial. Liquidity in a life insurance policy is a measure of the ease by which you can get cash from your policy while you are alive.

While life insurance policies are structured to provide financial security to your beneficiaries. The concept applies mostly. What is liquidity in a life insurance policy.

This means that you can access the money in your policy whenever you need it. In life insurance liquidity refers to the ease with which you might withdraw funds from your policy. The concept of liquidity in a life insurance policy essentially applies to.

In life insurance the term refers to how easy it is for someone. Now this feature if. With respect to life insurance liquidity refers to how easily you can access cash from the policy.

Liquidity refers to how readily available the cash. One of the key benefits of having a life insurance policy is that it gives you liquidity. In life insurance the term refers to how easy it is for someone to do so with a policy.

With respect to life insurance liquidity refers to how easily you can access cash from the policy. With this type of insurance a portion of your monthly payment is set aside and either put into a cash account or invested. Liquidity in life insurance refers to how easy it would be for you to access cash from your policy.

The liquidity of a life insurance policy refers to the availability of cash value to the policyholder. Here are a few other questions to help clarify life insurance.

Life Insurance Loans And Why We Use Them Privatized Banking

What Is Liquidity And Why Is It Important Thestreet

Keep Assets In Place With Insurance Premium Financing Commerce Trust Company

What Issues Should I Consider When Purchasing A Life Insurance Policy Isc Financial Advisors

Life Insurance Liquidity Achieve Financial Goals Paradigm Life

:max_bytes(150000):strip_icc()/TermDefinitions_Template_liquidity.aspcopy-30676aef2e424e55bd5ab2b1a8e54b44.jpg)

Understanding Liquidity And How To Measure It

Life Insurance Policies And Plan Template Presentation Sample Of Ppt Presentation Presentation Background Images

I Paid How Much For Life Insurance Nasdaq

What Is Liquidity Role Of Liquidity In Financial Planning

Understanding Life Insurance What Policy Type Is Best For You

Is Whole Life Insurance Right For You Consumer Reports

Understanding The Basics Of Infinite Banking With Whole Life Insurance

Basics Of Life Insurance Types Of Life Insurance Products Youtube

Ultra Hni Clients Buy Life Insurance Even If They Don T Need It Now Why Liquidity A Lot Of Super Rich Families Are Asset Rich But Liquid Poor The Life Insurance Policy Becomes

A Dozen Uses Of Life Insurance In Estate Planning Ppt Video Online Download

What Does Liquidity Refer To In A Life Insurance Policy Everly Life

1 Introduction This Chapter Explores The Problem Of Liquidity Risk Faced To A Greater Or Lesser Extent By All Fis Liquidity Concerns Continue To Be A Ppt Video Online Download

:max_bytes(150000):strip_icc()/UnderstandingLiquidityRisk32-e6abfec5376d4c85a60e0565eb856d37.png)

:max_bytes(150000):strip_icc()/LiquidityinInvesting-f3d51f463daa42c7a700e7e5916d4efa.jpeg)